There are many people that make good money at their jobs but have a low credit score for a variety of reasons. Some have had financial trouble in the past while some others do not have enough of a credit history for the highest credit scores. If you are looking to improve your credit score, there are a number of steps you can take to increase your credit score as much as possible. Some of these tips apply to people in particular financial situations and others are tips that anyone can use to find success at raising their credit score.

Step 1 – Review Your Credit Reports For Errors

Errors on your credit report can drag down your credit score by a considerable amount. Get a free copy of your credit report from each of the three major credit bureaus at www.annualcreditreport.com and review them for incorrect information and accounts that you did not open. Report any errors to the credit bureau that issued the report to start the process of removing the incorrect information.

Step 2 – Bring Any Past Due Accounts Current

If you have any accounts that are past due, but not yet in collections, your next focus should be bringing these accounts current. Even though the negative information about the account becoming past due will remain on your credit report, bringing the account current will stop negative entries on your credit report and the positive account information will eventually outweigh the negative information.

Step 3 – Pay Down Your Credit Card Balances

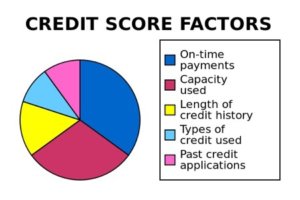

Having a high balance on a credit card can also be a drag on your credit score. Pay down all of your credit card accounts to less than 50% of your total available balance to see an almost immediate increase in your credit score. The highest credit scores are reserved for those who use less than 30% of the credit that they have available.

Step 4 – Open New Credit Accounts In Other Categories

If your credit score is low due to a credit history that is minimal, you should apply for credit in different categories, such as a car loan, a personal loan, or a purchase that requires fixed payments to a lender that reports credit information to the credit bureaus. Be sure to only accept credit that you can afford to repay or negative information about the account will bring your credit score back down.