However, without having a robust savings, so many crucial purchases are out of reach. When it comes to holiday shopping, you struggle to afford anything on your loved ones’ wish lists. Renovations and home projects are impossible without a sturdy nest egg to fund your ideas, and you end up arriving empty-handed to major life milestones like baby showers and weddings. Worst of all, if catastrophe strikes, you have no cash to rely on while you get back on your feet. Savings plans are not only essential for adult living, they’re also lifelines.

It’s easy to tell ourselves that we’re “bad at money” as an excuse for never establishing a savings plan. YOLO, right? What’s the point of saving money when momentary happiness depends on bagging that $500 outfit? Yet, the inability to save has become a national epidemic. According to a Bankrate.com survey, only 37 percent of Americans have enough funds in savings to pay for an unexpected expense. Sixty percent said they would cut back on spending in order to cover those costs, and 12 percent would rely on credit cards in the case of a financial emergency. In a survey conducted by Google, 62 percent of Americans said their savings accounts have less than $1000. Twenty-one percent of those surveyed said they don’t even have a savings account. Back in 2015, the Pew Charitable Trusts found that one in three Americans had absolutely no savings, and for folks making over $100,000 a year, that figure was one in 10.

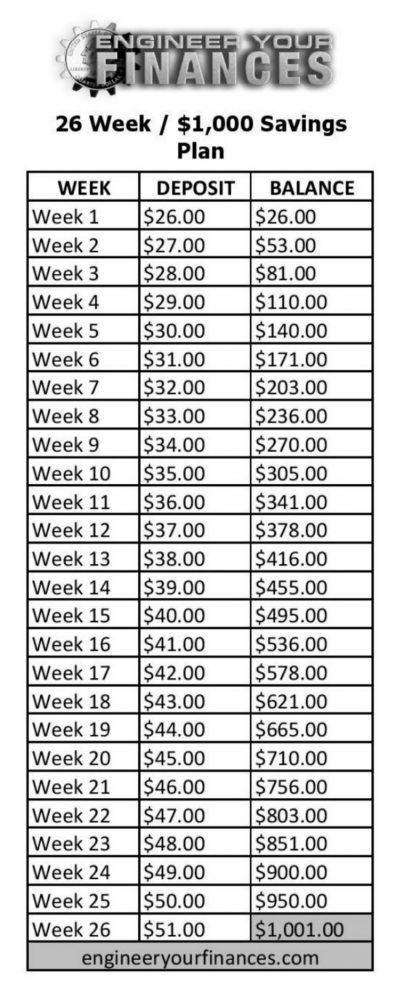

With low CD rates and high-yield savings accounts only offering unpredictable and often stingy rates, there’s very little appeal in opening a traditional savings account. However, there are other creative and ad-hoc approaches to savings that are turning out effective results. Take for example, the 26-week savings plan. In just six and a half months, you can save $1,000 with very little effort.

The 26-week plan is both easy to follow and requires minimal capital to get started. The first week requires a deposit of $26, the second week $27, the third week $28, and all subsequent deposits for the next 23 weeks are made with dollar increments. That means by the middle of the fourth month, you will already have $416 in savings.

Read more of our informative articles: