Recently I’ve been reflecting back to March 2009. My interest in behavioral finance probably stems from the technical confusion with markets. From the collapse of Lehman on, another engineering friend and I traded daily emails attempting to make sense of what was happening. As news continued to worsen, we threw our hands up and proclaimed:

“TOO SCREWY – INCONCLUSIVE!”

Although I anticipated the answer, I needed to find a chart graphing historical events against the stock market. As you would imagine, the more severe the news – the more the market plummeted.

Back to 2009 – equities were at fire-sale prices, yet my urge to grab everything under the sun was relatively low. My wish list grew daily, but my executed orders were close to nill. Simply put, my brain was outputting conflicting messages. How could this be given I knew the Buffet adage, “Be fearful when others are greedy, be greedy when others are fearful”.

Mulling over this relationship, an interesting thought surfaced. Maybe it has less to do with

FEAR & GREED and more to do with

FEAR & EXPECTATIONS.

I’m basing this on a few ideas:

- Greed portrays, “what can I get now”, whereas expectations say, “what can I get in the future”

- Greed looks back on past performances while expectations look into future returns

-

Greed results in Expectations, but Expectations lead to Reactions

Finally, greed can be prevalent at all times. It would take a lot of convincing to have me believe people during The Great Depression weren’t greedy. Instead of stock returns their focus shifted to food rations or jobs – but the greed was still there. The transformation that occurred was with their expectations.

So why is this important? Because greed can be too hard to measure, but expectations are a PERSONAL reflection. This is why you have two sides being argued now. “Perma-bear” and “perma-bull” analysts are debating their skewed personal scales against the same market conditions. The bulls fear less and expect more while the bears are fearing more and expecting less.

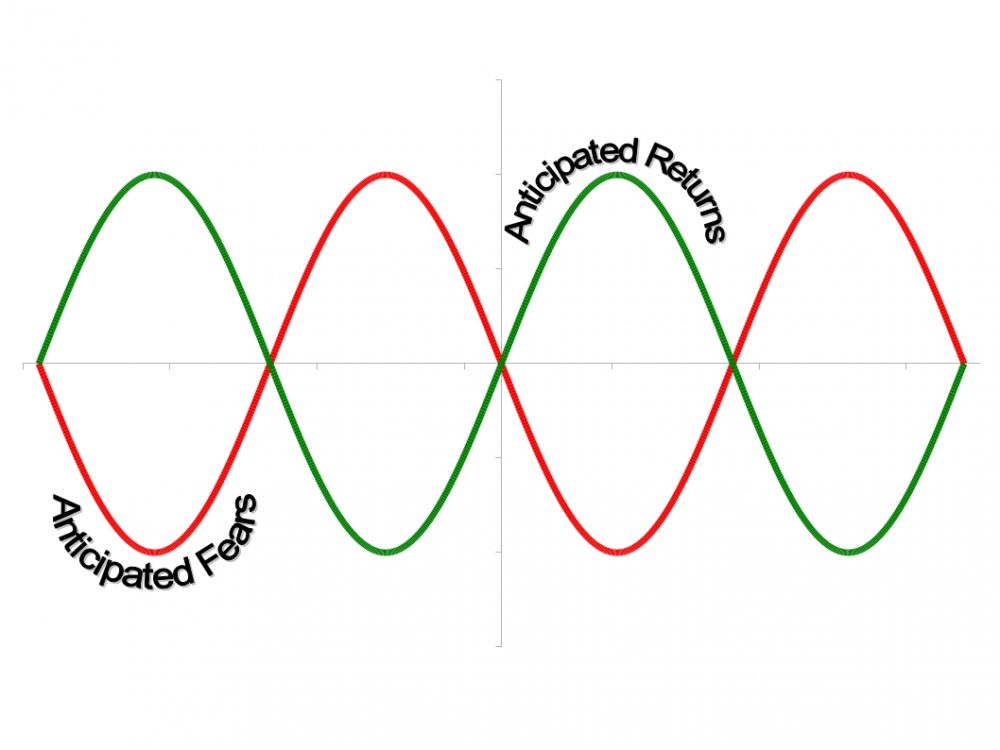

And there it is – the differences between expected risks & rewards fuel each other. As the chart below shows, the higher your anticipated fears the lower your anticipated returns and vice versa – just like the timeline highlighted.

There are numerous examples we could look at to illustrate how this plays out, but we’ll take employment for now.

Being fearless lead to greater expectations. When unemployment was low, people had no concern for losing their job. With everyone employed, the expectation was for inflation-adjusted performance reviews at a bare minimum. Not receiving a raise was considered a slap in the face and would easily prompt someone to leave for elsewhere.

Being fearful lead to lower expectations. With unemployment still teetering in the double-digits, now people have changed their tune. They’re just happy to be employed, and may not be expecting that annual raise.

Still working out how exactly you’d apply this to your own life, but here’s what I’ve got for now.

- Don’t focus on greed. It only confuses the situation

- Always look at cost-benefit analysis. Or in this case, expected risk vs. expected return

- Gut-check the risk/return factors. Is your return 2x the risk? Remember saying: “too good to be true…”