Lots of people have portfolios they’re comfortable with, that they believe in the strategies, and are sticking with these approaches for the long-term. But many may also have that nagging feeling of, “there could be more” or “there’s a better way to do this”.

As a way of grounding their investments, these people will often look towards technical analysis as a way of complementing their investing styles. On the spectrum, there’s a wide array of techniques: Elliot Wave Theory, Fibonacci Arcs/Fans/Retracements, & Relative Strength Index to name a few. Of course, even the most technical calculations are fallible as we learned with the prediction paradox.

Now – on to the product!

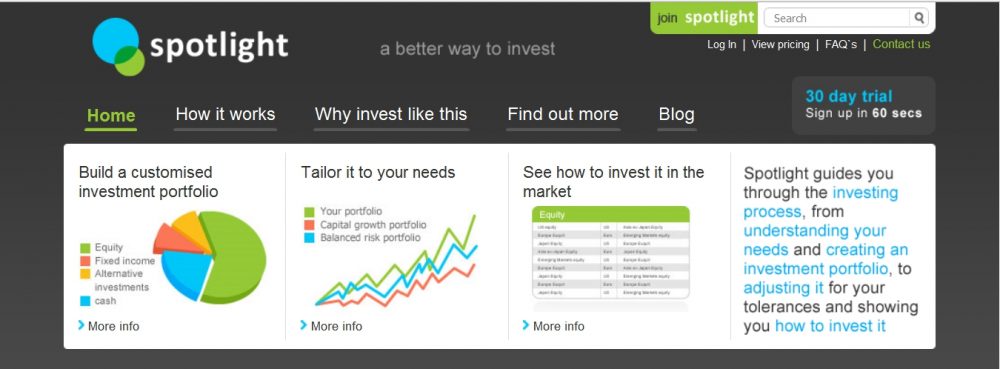

Spotlight Investing uses Modern Portfolio Theory, which seeks to maximize return while minimizing risk. What’s great about this practice is it utilizes those corny engineering buzz-words I love: Optimization & Efficiency! :)

First, you’ll fill out what seems like a standard survey. These initial steps create your hypothetical portfolios. You can go through this process many times and create different allocations. Eventually, the results show the likelihood of your returns given your various answers.

The next section, Analyze, offers a lot of useful information. There are 3 sub-sections, historical performance, projected performance, and one I really like – stress test.

While this information may seem too technical, what’s nice is while you’re going through the process, there are descriptions available explaining what’s going on and what they’re looking for.

Okay. So now that we have the input/output from our answers, we need to understand what we’re being shown right? In the third section, Understand, Spotlight aims to show us how our: time horizon, spending, and saving will affect our results. There are sliders you can play with that will automatically update the different cases presented.

Finally, you’ll arrive at the last section – Choosing Products. It’s worth noting that Spotlight Investing “does not make any money, either directly or indirectly, in any way, from any of the products, funds or securities in our database or shown through the service”. Combining these results with another power tool, the FREE Morningstar Instant X-Ray Tool, should help give you a very clear picture of your investments.

Alright, so now that you’ve read the review you’re interested. There are 2 products available.

- 60W Standard Version (reviewed) for $149/year.

- 100W Advanced Version (not reviewed) for $249/year.

- FREE 30-day trial periods are available for BOTH products.

If you are interested in subscribing to the program, we never worked out the details, but I bet you could secure a discount if you mention Engineer Your Finances to Mark.

I think these types of products will redefine the financial planning industry. Instead of paying a commission-based advisor or going to a salesman/investment counselor, you can get similar, if not better, information for a fraction of the cost. You also get much more with an email newsletter and the blog articles. This being the trend of providing more service, beyond the core capability, to the client for no extra charge.

Even if you see a fee-only advisor, those can cost $200+ per hour (although I still recommend them in specific instances). Assuming 8,760 hours per year, the 60W only costs $0.017/hour while the 100W costs $0.028/hour for a yearly subscription. Of course, you won’t be managing your portfolio every single hour of every single day…