As the clock ticked down to one of the most dreaded days of the year—Tax Day—nearly 28 percent of Americans had yet to file their taxes. In the midst of the pressure, you may be prone to make some mistakes out of haste. For your convenience, we’ve put together a list of some last minute tax tricks. From e-filing to direct deposit, you may be able to your maximize your refund next year.

E-File for Convenience and Speed

Since 2001 the percent of Americans filing their taxes online has nearly tripled. The rise in technological advancements and access to the internet has allowed more individuals to make use of the electronic filing option offered by the IRS. From only 31 percent to 81 percent, the raw numbers hovered around 28.8 million in 2012. Completing your tax return from home allows you to evade pricey tax programs and if you’re a bit tight on time, you have until 11:59 p.m. on April 15th to click submit.

Refunds through Direct Deposit

Compared to paper-filed tax returns which take around six to eight weeks to process, electronically filed returns using direct deposit are generally issued in three weeks or less. The benefits seem endless when it comes to e-filing. Chalk it up to the digital era!

Put a System in Place

We cannot overemphasize the importance of organization when it comes to the IRS. Do yourself a favor and keep all financial documents in one, safe place from the moment your receive them. Sometime around late January you should get your W-2 from your employer. If you’re paid as an independent contractor, instead you’ll receive a 1099. Juxtapose these financial statements against the official tax forms to ensure that all your I’s are dotted and T’s are crossed.

Consult a Professional

With over 70,000 pages in the tax code, it not surprising that most Americans turn to a tax specialist. A tax specialist has the education and tools in place to get you the maximum refund at minimal cost to you. “U.S. tax laws are extremely complex, so it’s impossible to make a universal statement about who is and isn’t qualified to pursue specific tax routes. Your tax attorneys at Levy and Associates are specialists in this complicated legal field, and we can review the specifics of your particular case to help you understand your options for resolving your tax problems,” says Lawrence Levy, of Levy and Associates.

Procrastinators Can File an Extension

If you’re in a bind and don’t think you’ll meet the April 15th deadline, you have the option to file an extension which extends a total of six months. This does not mean that you can postpone your tax due, but it will allow you extra time to collect all the tax forms and documents you need. Moreover, it may reduce the penalties charged. The typical penalty is 5 percent of whatever your balance is per month of deferment. If you file an extension and submit your information by the October date, this penalty will be waived. Here’s a brief overview of how to file an extension:

- E-file with Form 4868. We recommend this route because it’s the quickest and most efficient way.

- Fill out the aforementioned form and send it to the IRS via mail.

- Use the Electronic Federal Tax Payment System (EPTPS) to pay what you expect to owe. Based on IRS regulations, you’re required to pay at least 90 percent of what you owe to avoid additional fees.

If this still ambiguity or uncertainty regarding your tax responsibilities, consult an tax specialist.

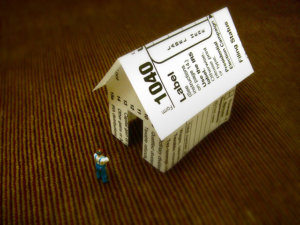

Photo courtesy of JD Hancock