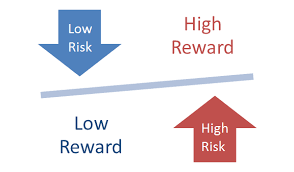

It’s hard not to notice how well the stock market has performed this year: The Dow Jones Industrial Average has rocketed up about 23% since the beginning of 2017, which some might say is three times as fast as the historical average rate of appreciation in stocks. So does that mean it’s a good time to increase the amount of stock market risk in your portfolio?

Conversely, the closer you are to your date of retirement, the less it behooves you to take on more risk. Ditto for anything approaching the date of your child(ren) beginning college or any other life event that might call for dipping into savings.

More Stock Market Risk

If you have more than a decade of investment time ahead of you, you might choose to allocate more money into stocks and embrace more market risk — as long as you don’t do it indefinitely.

You could make it an interim play that would enable you to reap more gains while the market trend appears to still be going up. Then you could always sell at a profit and move the proceeds back into safer investments like fixed income.

On the other hand, if you believe the market is near its zenith, then taking on additional stock market risk would not be prudent. You could either stay where you are or dial back your exposure to stocks.

Not All-Or-Nothing

You also don’t have to take an all-or-nothing approach to this; after all, if you sell everything and move it all into fixed income at the same time, you’ll have to pay a lot of capital gains taxes.

Instead, try moving gradually — the same way that professionals recommend for people who are within a decade of retirement. Incrementally move from stock to fixed income: A common approach calls for moving 10% of the balance of the portfolio each year.

Whatever you choose to do, remember that the creators of this blog do not qualify as licensed financial professionals — so seek out advice from a professional if you want a more expert opinion.

Lastly, if you’re reading this because you want to start buying stock but aren’t certain how to get started, consider reading stocktrades.ca’s summary on how to buy stocks in the USA and Canada.

Readers, have you pondered whether to take on more stock market risk?

Jackie Cohen is an award winning financial journalist turned turned financial advisor obsessed with climate change risk, data and business. Jackie holds a B.A. Degree from Macalester College and an M.A. in English from Claremont Graduate University.