Although approximately 41% of the population prefer newly built homes to older properties, a new house can still come with its share of stressful and expensive issues. Learning how to budget for emergency home repairs is essential. But if you don’t know where to begin, this guide might help.

Establish an Emergency Fund

A recent Bankrate study found that 32% of Americans between the ages of 53 and 62 had zero dollars in their savings. But seniors aren’t the only ones who came up short. The Federal Reserve reports that 40% of Americans can’t afford to cover a $400 emergency due to a lack of savings, and another study by Liberty Mutual Insurance found that 48% of Americans have less than $1,000 saved for home maintenance, with one-third of owners having budgeted nothing at all for this purpose.

If you don’t already have a “rainy day fund” set aside for home emergencies, you need one. It should be a savings account attached to your checking account (from which you will ideally transfer a set amount automatically). That way, you can passively build up this fund and easily transfer money if an emergency arises.

Know How to Budget For Emergency Home Repairs

Many experts recommend that you budget 1-2% of your home’s purchase price for annual maintenance and repairs. If you paid $250,000 for your home, that means you should set aside $2,500 to $5,000 on a yearly basis. Others recommend that you set aside $1 per square foot annually.

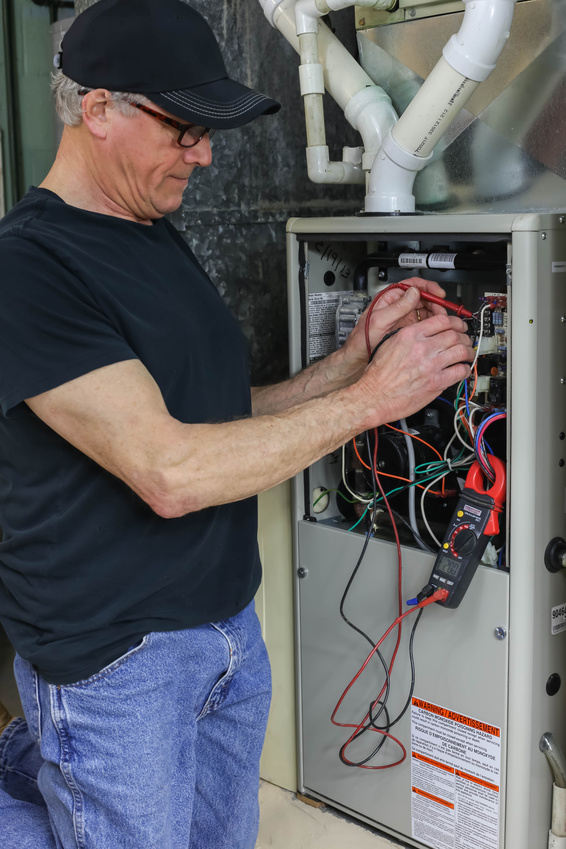

Some contractors recommend that you save the equivalent of three to six months’ worth of home expenses. Keep in mind that repairs will probably cost more than you think: roof repair costs $774 on average, and the average cost of furnace replacement is $4,000. If you save only $2,000 a year, you might find yourself in a financial struggle. It’s a good idea to save as much as you can to give yourself a comfortable cushion.

Get Your Home Inspected Prior to Buying

Before you ever even buy a home, you need to have it inspected. While this won’t give you a detailed account of everything that could require repairs, it can provide a good heads-up about what might fail next. You can even get an inspection if you’ve been living in your home for some time. You should also go over your home insurance policy to see what might be covered (and what definitely isn’t) to get a better idea of how much to budget for potential repairs.

Don’t DIY the Big Stuff

Some homeowners think they’ll save money on repairs by going the DIY route. But unless you really know what you’re doing, that’s going to actually cost you money. For the cost of fixing and re-doing the repair you messed up. You could have hired a great contractor and had money left over. The U.S. construction market was worth $1,162 billion in 2016. That doesn’t mean it’s not worth paying for these services. In many cases, it truly is more cost-effective — assuming you have the budget to pay for it in the first place.

The reality is that many American families do not currently have savings set aside for emergency repairs. By planning ahead and having a better idea of what to save, you could prevent taking on a financial hardship. y Don’t wait start learning how budgeting for emergency home repairs today.