Erase bad credit instantly — that’s the sense of urgency many people have when their housing situation changes, they need to borrow money for an emergency, or even when informed that a prospective employer might do a credit check.

Do yourself a big favor and try to quell your impatience about wanting to get your credit fixed — the Federal Trade Commission warns that marketing messages appealing to a sense of urgency about credit repair might indicate a scam. The FTC says it’s possible to do your own credit repairs without having overspend on services.

Pacing of Repairs Depends on Starting Score

Some ironic good news for those with bad credit: The lower your rating is to begin with, the more room you have for improvement, including a few things you can fix right away. As your credit score goes from poor to fair, you might notice more gradual changes — and similarly, as you get closer to a good score, subsequent increases can take even longer.

How long does it take to improve your credit score? That depends on your current score — the lower it is, the more room you have for improvement — and on what kind of actions you take.

Although it can be next to impossible to go from a poor to an excellent credit score overnight, the initial changes you make can have a snowball effect on getting you toward a better rating.

1. Polish Your Credit Report

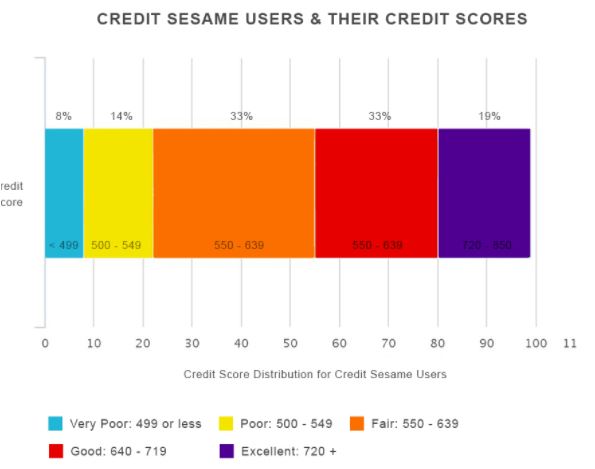

Before you can get to the quickest fixes, it’s a good idea to obtain a free credit score to see where you are. About 22% of the population has a poor or very poor score, according to Credit Sesame, which defines this range as 499 or lower. Another 33% have a fair credit rating, from 550 to 639, and 33% have a good credit rating of 640 to 719, as you can see in the chart below.

You’re entitled to one free credit report a year from each of the big three agencies: TransUnion, Experian and Equifax. Obtain yours online and as soon as you see it, save a copy on your computer (or print it out if you’re good at holding on to paper). A great website to use for this purpose is annualcreditreport.com.

Before you log off of the websites(s) of each agency, carefully read the report with a view towards disputing any errors you might find. You will achieve quicker improvements in your credit rating if you submit disputes online than if you do it by postal mail.

Dispute Negative Information

As you read through your credit report, pay close attention to the sections dealing with specific account histories. The data shown is usually time delayed and it behooves you to update each of them with the current balance, status of payments and their timing, along with anything listed as negative. This can include:

- Late payments

- Overdue or unpaid bills

- Collections agency activity

- Defaults

- Liens

- Bankruptcies

Don’t overlook sections like credit inquiries, where you can challenge any that you did not authorize yourself. Just know that you will need to provide proof that you did not authorize what you are disputing. This is why keeping solid financial records is important.

Document Corrections

Find documentation that can correct details surrounding anything listed as a negative, even if it’s just a matter of dates.

Upon submitting a dispute to the rating agencies, retain any confirmation number that you receive so that you can follow up. You should get a response within three months at the most.

Note that while the agencies tend to share information related to disputes and reports of identity theft, don’t assume this happens consistently. Follow up with all three agencies about your disputes. In most cases, you have to wait for the credit agencies to resolve all outstanding disputes before you can file any new ones.

2. Pay Down Balances

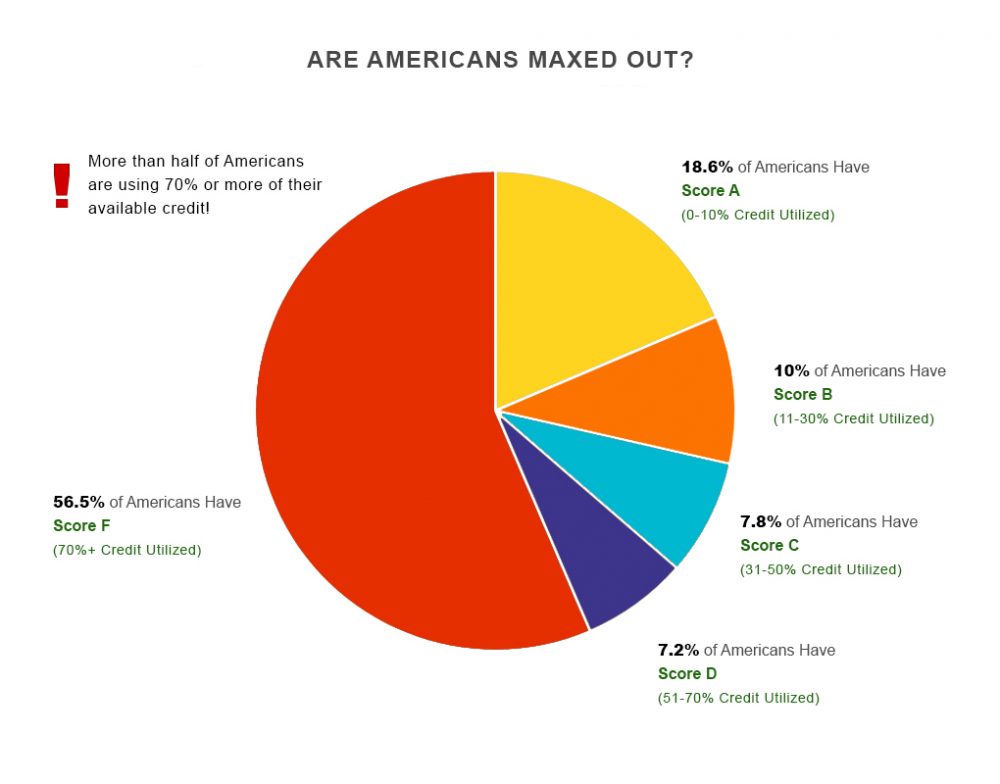

Your credit report should also give you some clues about other things you can improve, like paying down outstanding balances. This affects up to a third of your FICO score, according to myFICO. It’s actually the ratio of outstanding debt to available borrowing capacity.

If you are using more than a third of your total credit limit across all your accounts, paying down your balances will increase your credit score quickly — especially if you remember to hold off on any new borrowing until you can pay off those balances. The ideal percentage you want to remain at is 1-10%. This increases your credit the quickest, as it shows that you still use your credit, but you do so responsibly.

3. Pay Sooner

Account providers report balances to the rating agencies once a month, so if you start paying down your balances before the deadline shown on your statements, you can improve your score, according to Bankrate.

Or, if you’re really disciplined, you could step up your repayment game by paying down your balance twice a month or more. The nice thing about paying down balances more often: you don’t have to curtail your card usage to keep your credit score in line, so you can still accrue loyalty points on your cards.

If you need help getting to a point where you can pay down your balances more frequently, look into taking on a side hustle or at least selling items that you are not using.

4. Get More Borrowing Power

Another way to improve your score addresses the other aspect of your ratio of outstanding debt to available borrowing capacity.

You can reach out to all of your account providers and ask for an increase in your credit limit. Remember not to use the additional borrowing capacity or you’ll wind up back where you started, however. Certain creditors won’t even do a hard pull on your credit, keeping your inquiries in check. Call your creditor to confirm whether this is the case before you request any increases.

If your current account providers don’t want to up your credit limit, you can also open a new account with another card issuer. Be careful with how many you apply for, as hard inquiries do affect your credit– especially when there are a bunch at one time.

You also don’t want to have too many accounts that you can use for borrowing, or it can start to work against you. It’s also not advisable to open lots of new accounts all at the same time either. This is because your average credit age affects your scores, and bringing up a bunch of brand new accounts will lower that average age.

5. Negotiate With Creditors

If you have any bills that are being handled by collections agencies, you may be able to negotiate settlements with them that could include reducing the severity of what they report to the credit agencies. You’ll want to do this over the phone and then request an agreement in writing — then you can use this document later on if you need to follow up with any mistake on your credit report.

Also, if your balance with a collection agency is something you can take care of in one payment, try to give it directly to the original creditor rather than the agency. Then you may have more ability to negotiate for the activity to not show up in the negative section of your credit report.

Your leverage here comes from the fact that the original creditor recoups more money on the outstanding bill if you cut out the collection agency. Again, get an agreement in writing so you can follow up. For further advice on how to negotiate with creditors, there’s a whole chapter on this topic in Managing Debt for Dummies.

If you don’t have the money, that is when you can consider negotiating a lower payoff to the collection agency. These firms typically buy debt for pennies on the dollar, so you can often negotiate a much lower payoff and they will move on. This is because they make money by buying debts and turning them over quickly.

6. Get Your Name Put on a Loved One’s Card

If your credit score is in a state where you don’t even have any card accounts you can demonstrate improvement on, there’s another way. You can ask someone to add you as an authorized user on their account.

Ideally a relative might be able to do this for you if there’s a lot of trust. Make sure you ask someone who has excellent financial habits; and, swear up and down that you have no intention of actually using the card. You could even tell them to keep the actual physical card and just make you an authorized user in name only for now.

Once this goes through, the account will show up on your credit report, along with all of the owner’s good behavior — good credit utilization and on-time payments.

there are many creditors cracking down on this trick, so don’t expect it to last too long. It is, though, a decent way to start building credit when you have none.

Wait It Out

Remember that the worst things that can appear on a credit report (like bankruptcies) take up to seven years to disappear, so there’s only so much you can do that would take effect as quickly as you might hope.

However, a year from now you might see enough improvement to feel more confident about any goals that require a credit check.

Whatever your starting score may be, of course, the sooner you can raise your credit score, the more choices you have when it comes to lenders, card issuers and installment purchase plans. Good luck on your quest to improve.

Read More

And if you want to keep learning about how to improve your credit score, be sure to check out these other articles:

- What Is a Credit Score and How Will You Know Yours?

- What Credit Score Does Everyone Start With

- Increasing Your Credit Score Gives You These Great Benefits

- These Unthinking Actions Can Kill Your Credit Score

- How a Bad Credit Score Affects Your Life

- Tips That Keep Your Credit Score High

- Understanding Your Credit Score Will Increase Your Financial Security

- Using Loans to Improve Your Credit Score

- Credit Score Myths We Can Ignore

Sponsors note:

This article was generously made possible by the team at Max Cash Title Loans. Max Cash Title Loans is your one stop title loan shopping marketplace. If you need information about how to get a title loan or want to apply for a title loan, they can help.

Trey LaRocca is a freelance writer, financial sales worker, and tech guy. When he isn’t out and about or at work, he’s usually at home enjoying some video games and a beer. Currently residing in Newport Beach, this California Kid can be found at the beach on any given weekend. Trey has years of experience in day/swing trading, financial analytics, and sales.