“Wedded Bliss and Taxes: How getting married and how you file (jointly or separately) affects how much you will owe in taxes” is a guest post offered by H&R Block’s Leigh Mutert, CPA and hrblock.com Community Manager.

She’s also given us FREE copies of H&R Block Federal Premium Edition! It’s tax season time and who wouldn’t want something premium for free :) We’re giving away FOUR copies. To enter – Comment, Like, & Tweet this article! The winners will be announced on Sunday, Feb. 20th.

How you file can mean tax savings in your pocket.

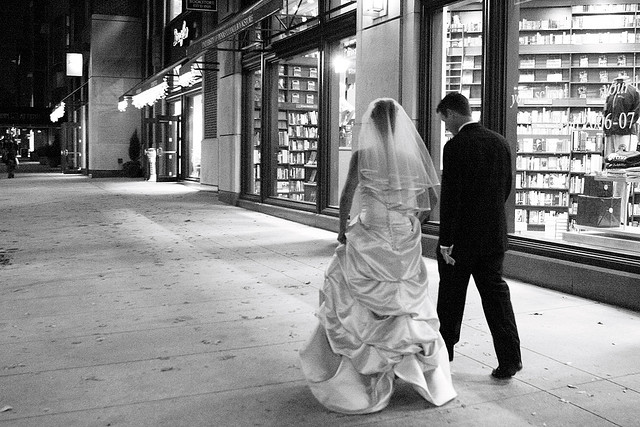

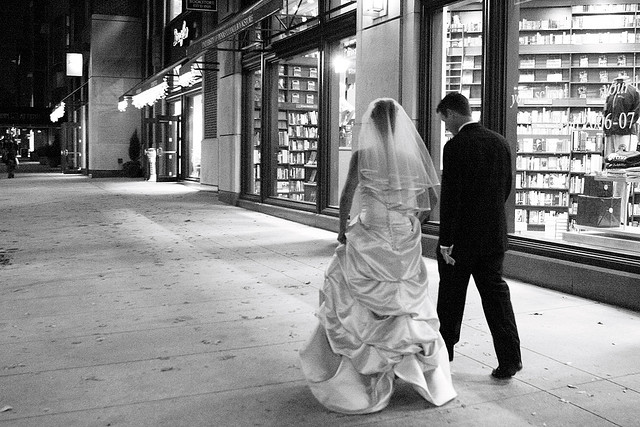

Marriage means compromise. It means negotiation. It means having to decide a million things as a couple: where to live, when to have kids, how to juggle the holidays between all the in-laws.

Your status on the last day of the year determines your filing status for the entire year. If you’re married, you and your spouse can choose to file a joint return or file separate returns. Unless you are required to file separately, you should figure your tax both ways (on a joint return and on separate returns) to determine which filing status is best for you.

Most taxpayers claim the standard deduction — a fixed amount that reduces the income on which you are taxed. Here are the standard deduction amounts according to filing status.

- Single or Married Filing Separately: $5,700

- Married Filing Jointly or Qualifying Widow(er): $11,400