If you’ve heard of Zillow, and like it, then you need to check out FinestExpert.com. A guest post from Dr. Boyer, the article argues that one can’t simply look at interest rates when considering mortgages. Understanding other factors, like how long you intend to keep the loan, are required in order to make the right decision.

“How do I compare rates to find the best mortgage?” is often the first question people ask when considering mortgage refinancing or when looking at homes for sale as investment property, a second home, or primary residence. Industry standards are evolving but it is still difficult to compare mortgage interest rates on an apples-to-apples basis between different mortgage lender loan programs.

To compare home loan rates, it is important to compare the same type of bank mortgage loan program – e.g., start with a fixed mortgage and pick a 30 year mortgage or a 15 year mortgage. Then there are three keys to evaluate the best home mortgage loan for you.

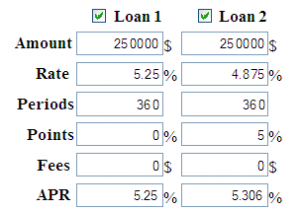

2. Annual Percentage Rate (APR) attempts to solve the problems of simply comparing home mortgage loan rates by including all of the lender fees to calculate the true loan rate that is effectively being charged by your mortgage broker. Per the Truth in Lending Act (TILA), mortgage lenders are required to disclose this information as the APR to give you a consistent means of comparing rates and programs. But, the APR calculations assume that you are comparing 30 year mortgage rates (or whatever your term) and that you will hold your loan until it is paid off in full.

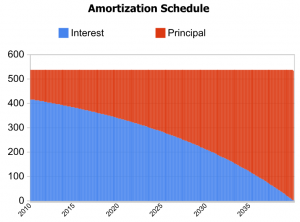

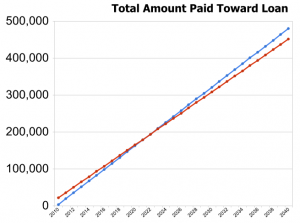

You need to compare rates by manually analyzing the amortization schedule of each loan in question (identifying total principal and interest paid) or else by using a loan comparison tool that will graphically show you the time frame during which each loan is better than the other.

The best mortgage interest rate is one that fits you, regardless whether it is for a mortgage refinance, bad credit loan, or home loan mortgage. To determine the best refinance mortgage rate for you, either check the amortization schedule of each loan or use a loan comparison tool.

About the Author

Robert T. Boyer, Ph.D. is the co-founder of FinestExpert.com, the place real estate investment property search and analysis. Boyer invented the concept of Real Estate Financial Planning. He is both a licensed mortgage lender and real estate agent, living in San Diego, CA.