A credit score is a three-digit number that predicts how likely you are to repay your debt based on your credit history. Essentially, it’s the numerical equivalent of your creditworthiness.

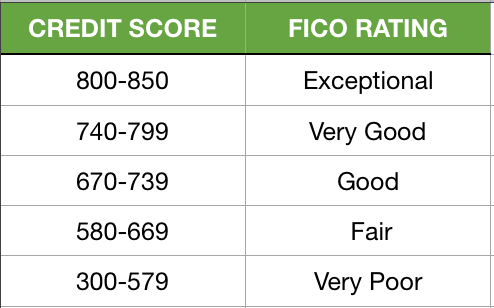

Credit scores range from 300 to 850 with the average credit score in the U.S. hovering around 680, dependent on the credit model utilized. The higher the number, the more attractive you are to a lender.

How Age and Income Impact Your Credit Score

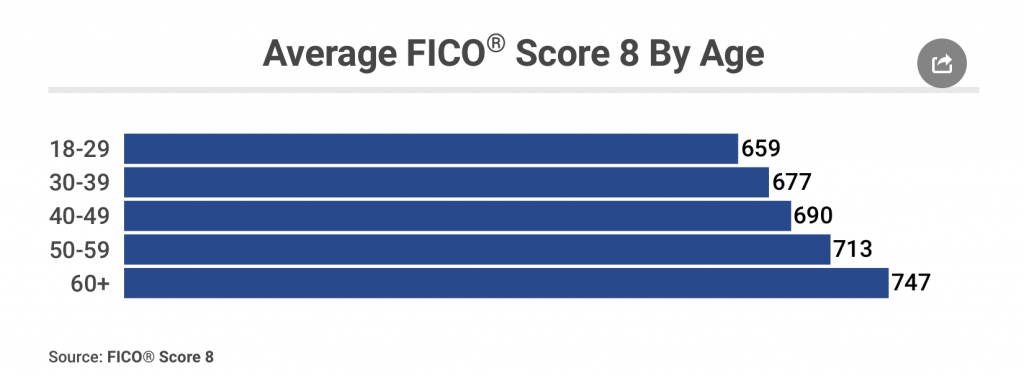

Lenders cannot approve nor deny you credit based on your age, however, a pattern does exist between age and credit scores. So, while age doesn’t have a direct impact on your credit score, it can affect it.

In general, credit scores improve with age. This makes sense because the older people get, the more financially stable they are. Incomes are higher, they are financially secure, and time is in their favor, as they’ve had time to recover from poor financial choices.

Income is another factor not directly tied to your credit score, but one which indirectly affects where you land on the credit scale. The younger you are, the earlier you are in your career, thus you likely have a lower income. Income brackets determine the affordability of credit, thus may lead to denial of credit for something like a personal loan or a reduced credit line.

According to Money.com,

“There is a 91-point difference between the average scores of those in the oldest bracket of consumers and those in the youngest group, according to a new analysis that FICO performed for MONEY. With each decade, the average score increases by about 20 points.”

How Do You Compare With Your Peers?

Are you curious where your credit score lands relative to others in your same age bracket?

Experian published a credit score by age chart:

What if Your Credit Score Is Too Low?

If you’re planning to take on some debt, such as purchasing a home, knowing how you stack up against your peers is important. But keep in mind these are average scores. Based on this chart, those in their thirties are generally in the poor range, which is surprising. However, you can have great credit at any age.

If your credit score is lower than it needs to or should be, the best time to work on improving it is now. It can take a bit of time to see results.

Here are a few tips to help drive up your three-digit score.

Always make your payments on time – 35% of your credit score is determined based on timely payments.

Keep old accounts open – 15% of your credit score is based on the length of time passed since credit was opened.

Monitor your credit report on a regular basis – look for errors in your credit report which may be harmful.

Start paying off your debt – a portion of your credit score is based on credit utilization which is total credit card debt divided by your total credit card limit. Keep this metric below 30%, according to Experian.

How does your credit score stack up against others in your age group? Let me know in the comments below.

Read More:

- Increasing Your Credit Score Brings You These Great Benefits

- Understanding Your Credit Score Will Increase Your Financial Security

Kate Fox is a former CPA, with twenty years of experience in public accounting and corporate finance. Born and raised in Alaska, Kate is currently based out of southeastern North Carolina. She loves coaching others on personal finance and spends her free time traveling with her family or relaxing by the pool with a good book, probably about money.