It is amazing to me that so many people in the United States have no clue what their credit score is or how that three-digit number affects many different areas of their lives. Many seem to think that their credit score will take care of itself as long as they do not pay any of their bills late. Imagine how surprised they are when they find out their credit score is less than perfect when they have never had an account go delinquent or even made a payment late. Understanding your credit score and how it affects you financially will go a long way towards helping you increase your financial security. Here are some of the things that you should know.

Credit Score Basics

Your credit score is a calculation of your credit-worthiness that lenders and others use as a gauge of the risk you pose to their company. Lenders use your credit score to determine whether you qualify for one of their loans and the interest rate you should be charged for borrowing money. Landlords and property owners check the credit scores of potential renters to determine whether they will be diligent about paying their rental payments on time. There are even some employers that review the credit scores of potential employees that would be placed in positions of trust once hired. The most commonly used credit score is the FICO score, although there are others that use slightly different calculations to come up with your personal credit score.

Credit Score Factors

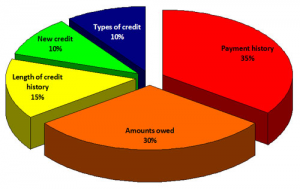

There are a number of different factors that go into the calculation of your credit score.

- Credit utilization rate – the amount of your total available credit limit you’re using.

- On-time payments – your ability to pay your bills on time.

- Number of negative reports – these reports include bankruptcies, foreclosures, accounts in collections, tax liens or civil judgments.

- Length of credit history – amount of time your accounts have been open, averaged across all your accounts.

- Number of credit accounts – total of all types of credit accounts, including credit cards, auto loans, mortgages and other loans.

- Number of hard credit inquiries – hard inquiries are reported whenever a lender requests your credit report to make a decision on whether to approve your application.

Improving Your Credit Score

If you want to get the lowest interest rate for your loans and increase your chances of being approved for the things that you want, you will want to keep your credit score as high as possible. A great credit score is generally a FICO score of 720 or higher, while a decent credit score is typically around 650. For a great credit score, keep your credit card balances low, be careful to never miss payments, and only apply for credit when you really need it to minimize the number of hard inquiries reported.