While different socioeconomic groups have unique spending habits, specific patterns set them apart. For example, the rich won’t be afraid to spend on more healthy foods; the poor will spend most of their money on bills. Interestingly, each group wastes their money differently.

Here are 14 things poor people waste money on that the middle and upper classes do not.

Gambling and Lottery Tickets

Low-income individuals spend a lot on gambling and lottery tickets. These schemes seem like a quick fix to financial problems like earning more money or getting out of debt, but they often result in financial loss. Understanding wealth-building hacks like consistent saving, reducing expenses, and working with a financial expert will help you solve your financial problems and achieve financial freedom.

Fast Food and Takeout

The poor are more likely to spend a lot of money on fast food and takeout as it’s relatively inexpensive and easily accessible. Cooking your meals at home is cheaper than regularly dining out and taking out.

High-Interest Debt and Payday Loans

Credit cards and payday loans offer a convenient solution when you need to sort out a financial problem or purchase something immediately. Sadly, most poor people are caught up in a cycle of debt as the high-interest rates and fees make repayment a challenge.

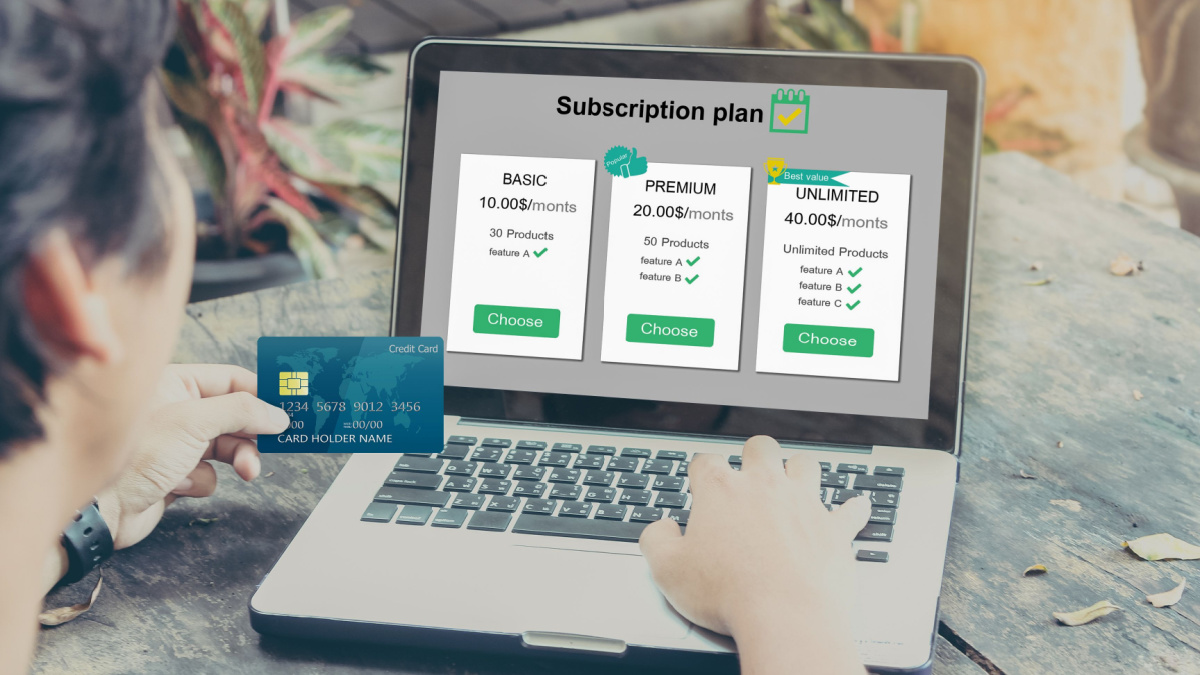

Unused Subscriptions

Research by Chase Bank revealed that 71% of Americans waste over $50 on unwanted subscription fees monthly. Having multiple subscriptions and memberships can seem insignificant for poor people, but the costs quickly add up and can majorly impact your finances.

New Trendy Gadgets

Purchasing the latest gadgets when your current devices still fit your needs is a waste of money. Poor people will purchase new trendy gadgets to achieve a certain social status. That is money that could be spent on home repairs, car maintenance, or your retirement savings.

Brand Name Products

Low-income individuals love to spend on high-end brands due to the perception of quality. Some wil buy luxury brands for social status, while others feel a sense of accomplishment after splurging. Most of these products are more expensive and of lower quality. Choosing lesser-known brands can help you save money and find durable items.

Smoking and Vaping

Poor people waste a lot of money on smoking and vaping products. Statistics estimate that an average smoker spends at least $200 a month, which is $2,400 annually. That money could go into your retirement savings or buy a new car.

New Cars

Low-income people also spend a lot on the latest vehicles, which only add to the expenses. Holding onto your previous car as long as it’s functional or purchasing a pre-owned vehicle can significantly reduce your expenses and save money.

Frequent Drinking at Bars or Pubs

Individuals in the lower-income groups waste money popping beers at bars or in the club. While the experience might get you on a fleeting high for a few hours, the thrill slowly dissipates, leaving you broke.

Premade Meals

Premade meals are convenient as you don’t have to spend hours preparing food or cleaning multiple dishes. Unfortunately, the benefits don’t outweigh the costs, as most premade meals are expensive. It’s cheaper to make your meals at home.

Overdraft and Bank Maintenance Fees

Most banks have hidden fees that low-income individuals hardly pay attention to. Costs like high overdraft fees, maintenance fees, foreign transaction fees, and late fees can quickly add up in a month and create unnecessary financial strain.

Overpriced Cell Phone Plans

Poor people waste a lot of money on overpriced cell phone plans. Unfortunately, despite unlimited cell plans, most don’t use the services. Opting for a cheaper monthly plan from other cell carrier providers can save you money.

Non-Essential Home Decor and Accessories

Shopping for home decor to transform your space may seem like a great idea, but it could be a waste of money if you purchase different home decor items and accessories regularly. That money could be channeled to more essential purchases or go into a savings account.

Convenience Store Purchases

Low-income individuals tend to spend much more at convenience stores as they are open 24 hours a day, convenient, and affordable. However, most items at these stores, like bottled water, milk, bread, and coffee, are overpriced. You waste a lot of money at convenience stores as you’ll likely shop for more items that are not within your budget.

Financial Freedom

Understanding the spending patterns of different socioeconomic groups allows you to recognize the most common financial pitfalls and avoid them. Living within your means and not spending money on things you don’t need will help you achieve financial freedom.

13 Signs You’re Financially Better Off Than the Average American

Achieving financial stability where you can meet your current financial obligations comfortably and still plan for the future is a goal everyone strives to attain.

However, while you may be able to pay your bills, save for vacations, and afford to dine out occasionally, you may feel left behind, especially if you compare yourself with your peers or others with higher salaries. You may be doing way better financially than the average American.

13 Signs You’re Financially Better off Than the Average American

8 Things the Middle Class Won’t Be Able to Afford in Five Years

Unfortunately, inflation’s vice grip on the middle class shows no sign of relenting anytime soon. Here are eight things about to get significantly more expensive for those in the middle of the pack to fit into their quickly tightening budgets.

8 Things the Middle Class Won’t Be Able to Afford in Five Years

20 Luxuries That Were Attainable 50 Years Ago That Now Escape the Middle Class

Specific experiences and commodities from the past were part of everyday life, accessible to most, and cherished by many. Fast forward half a century, and you’ll find these once-common threads have become silken and exclusive, reserved for the wallets of the well-to-do.

The landscape has shifted from leisure activities that bond families and friends to necessities that ensure health and happiness.

20 Luxuries That Were Attainable 50 Years Ago That Now Escape the Middle Class

14 Companies That Will Give You Free Food and Products Just for Asking

More companies are now offering free samples to get customers to try a new product. Over time, these companies gain loyal customers and can increase their sales. As a customer, you also get to test out free products and sample foods you’ve never tasted.

Here are some companies that will give you food and products for free just by asking.

14 Companies That Will Give You Free Food and Products Just for Asking