Frugal living has become increasingly popular as costs for everything skyrocket. Inflation is rising, and salaries are dropping, creating the need for frugal living and more cost-efficient habits.

If you’re wondering how to implement frugal living strategies without making huge life changes, you’ve arrived at the right place.

Middle-class Americans are struggling with inflation and looking to live more frugally. They are overwhelmed with finances and looking to improve them.

As things become more and more unaffordable for the middle class, here are some great ways to get started living frugally.

Create a Budget

It might seem like common sense, but sometimes, the biggest thing you can do to implement frugal living is simply create and stick to a budget. Getting organized with your finances starts with ensuring you know exactly what you’re spending and where your money is going. Creating a budget that plans out how much you make and how much you’ll spend on specific items and ensures that you don’t stray from it can save you a great deal of money.

Cook at Home

One of the easiest things you can do to save money is to cook at home. Planning your meals out a week ahead and making a grocery list before going to the store can save you a lot of money. If you plan out meals, you can assess what ingredients you already have at home to afford to purchase extras. By having a list that you stick to, you can avoid impulse purchases and spending more than your budget allows.

Buy Generic Brands

You’d be surprised at the difference it can make in your expenses if you simply buy generic or store-brand items instead of the name brands. Usually, name brands are more expensive, and you’re spending more money to receive the same item.

Use Coupons and Discounts

If you’re willing to look a little, you can almost always find a coupon or discount for an item you’re planning to purchase. Finding a coupon or discount can help you save on purchases and will save you money in the long run. Download coupon apps on your phone so you can easily get all the discounts you need.

Get Stuff for Free

Cutting down on spending doesn’t necessarily mean you have to do without things you need and want. There are so many easy ways to get stuff for free if you use a little creativity and know where to look. Reach out to friends and online groups for items, especially clothes, people are giving away. Join swaps and trade with friends to share things you need.

Shop Secondhand

You can often find secondhand items for less than half the price if you bought them new. No matter what you need, you can usually always find it secondhand, and many times, you don’t even have to sacrifice quality.

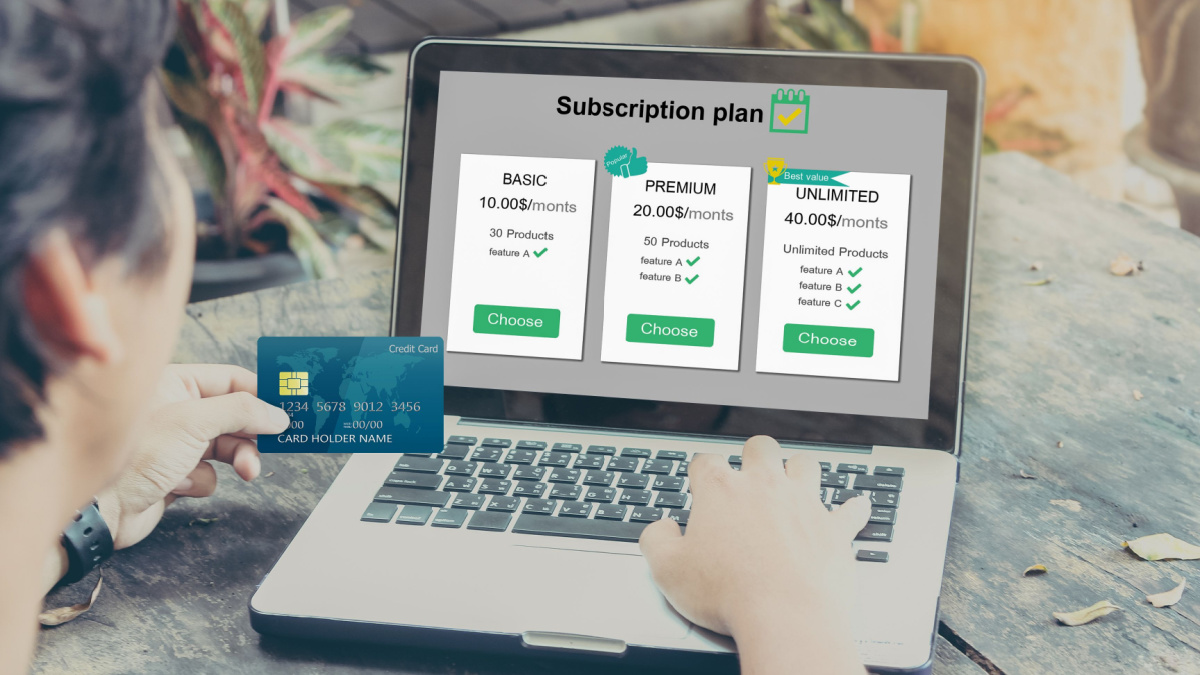

Cancel Unnecessary Subscriptions

Many people are paying for subscriptions and memberships that they aren’t actively using, and they don’t even realize that their money is going toward them. You can save money by assessing what subscriptions or memberships aren’t getting used or if you have duplicates. You can also look at your subscriptions and see which ones you aren’t using as often as others to save money.

Cut Back on Dining Out

Dining out is expensive; even when you think it isn’t much, it can add up over time. You’d be surprised at what the costs can be at the end of the month when you’ve been eating out, even just a few times. You can save immensely by eating at home and not ordering in or eating out.

DIY Cleaning and Beauty Products

You might want to make your own cleaning and beauty products at home for many reasons, but one of the best is to save money. Most homemade cleaning products cost less than a dollar to make and can save you substantial money.

Comparison Shop Before Purchasing

Don’t just accept the first price that you see when making purchases. You can find a cheaper price almost every time if you’re just willing to look around for it. You can call insurance, internet, and cable companies and ask prices until you find the cheapest.

13 Signs You’re Financially Better Off Than the Average American

Achieving financial stability where you can meet your current financial obligations comfortably and still plan for the future is a goal everyone strives to attain.

However, while you may be able to pay your bills, save for vacations, and afford to dine out occasionally, you may feel left behind, especially if you compare yourself with your peers or others with higher salaries. You may be doing way better financially than the average American.

13 Signs You’re Financially Better off Than the Average American

8 Things the Middle Class Won’t Be Able to Afford in Five Years

Unfortunately, inflation’s vice grip on the middle class shows no sign of relenting anytime soon. Here are eight things about to get significantly more expensive for those in the middle of the pack to fit into their quickly tightening budgets.

8 Things the Middle Class Won’t Be Able to Afford in Five Years

20 Luxuries That Were Attainable 50 Years Ago That Now Escape the Middle Class

Specific experiences and commodities from the past were part of everyday life, accessible to most, and cherished by many. Fast forward half a century, and you’ll find these once-common threads have become silken and exclusive, reserved for the wallets of the well-to-do.

The landscape has shifted from leisure activities that bond families and friends to necessities that ensure health and happiness.

20 Luxuries That Were Attainable 50 Years Ago That Now Escape the Middle Class

14 Companies That Will Give You Free Food and Products Just for Asking

More companies are now offering free samples to get customers to try a new product. Over time, these companies gain loyal customers and can increase their sales. As a customer, you also get to test out free products and sample foods you’ve never tasted.

Here are some companies that will give you food and products for free just by asking.

14 Companies That Will Give You Free Food and Products Just for Asking