Got bad credit? That’s ok, most lenders will still over a loan for up to 85% of your home value for up to 35 years!

That sounds like good news, right? Well, what if the lender forced you to sell your home in order to recoup their money?

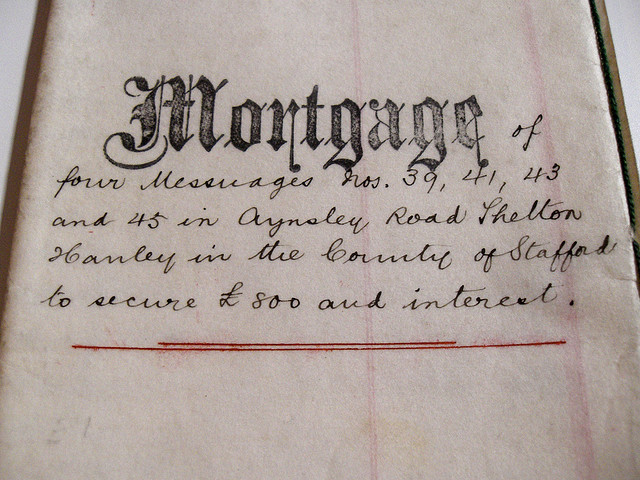

A homeowner loan means that the loan is secured against your home. So there is barely any risk for the lender, and you take on all the risk. Even if you don’t pay, the lender knows it can get their money back by taking control of the house and selling it. While it’s not an ideal situation for them, it’s better than giving unsecured loans which they would have little defense against if you stopped paying and filed bankruptcy.