Currently, there is a lot of economic uncertainty in the world, and this is coupled with increasing costs of living. This may push us to evaluate our lifestyle choices and overall outgoing money each month in case we feel any financial burdens.

It’s not fun for us to hear how we need to reduce our costs, but by implementing small changes in our financial choices, we will most definitely see a great impact on our overall savings. Here, we have listed some of how you can change some of your habits to increase your monthly savings.

Paying for Convenience

By simply planning and researching before any major spending, you could potentially save yourself a lot of money each month. For example, doing grocery shopping at a store with slightly inflated prices just because you like this particular store’s brand compared to other stores may be costing you unnecessary amounts of extra money each month.

Another example of how you are spending money on unnecessary convenience is signing up for meal kits when you could spend a little extra time cooking your food from scratch.

Impulsively Shopping

It’s okay to buy something outside of your budget now and then, but when this behavior becomes chronic, then you may have a problem on your hands. When you are impulsively buying something every time you want it but don’t necessarily need it, it all adds up.

This increases monthly spending, and when you do this a lot, it becomes the norm! The next time you want to purchase something that you don’t need, why not add it to a wishlist and visit the list a few months later to see if you still really want it?

Paying for Memberships and Subscriptions That You Rarely Use

It’s so easy to sign up for a free trial with a subscription and completely forget about it for months. Meanwhile, you started getting charged every month without even noticing it. You may also be paying for multiple streaming sites when you only need one.

Make sure you have a good look at all the things you are subscribed to, and if you don’t need or use them often enough, then it’s time to cancel them.

Avoid Shopping When Hungry or Sad

It’s well known that making a shopping trip when we are sad, or grocery shopping when we are hungry makes us spend more money on things that we don’t always need. You should avoid emotional shopping altogether, as when you are not exactly thinking straight when you are feeling sad or hungry.

Spending Too Much on a Car

At first, buying an overly expensive luxury car may seem like a great idea, but when trying to build your savings, this is not the way to go. Why spend an obscene amount on a car when you can spend a normal amount on the same thing that will also get you from A to B?

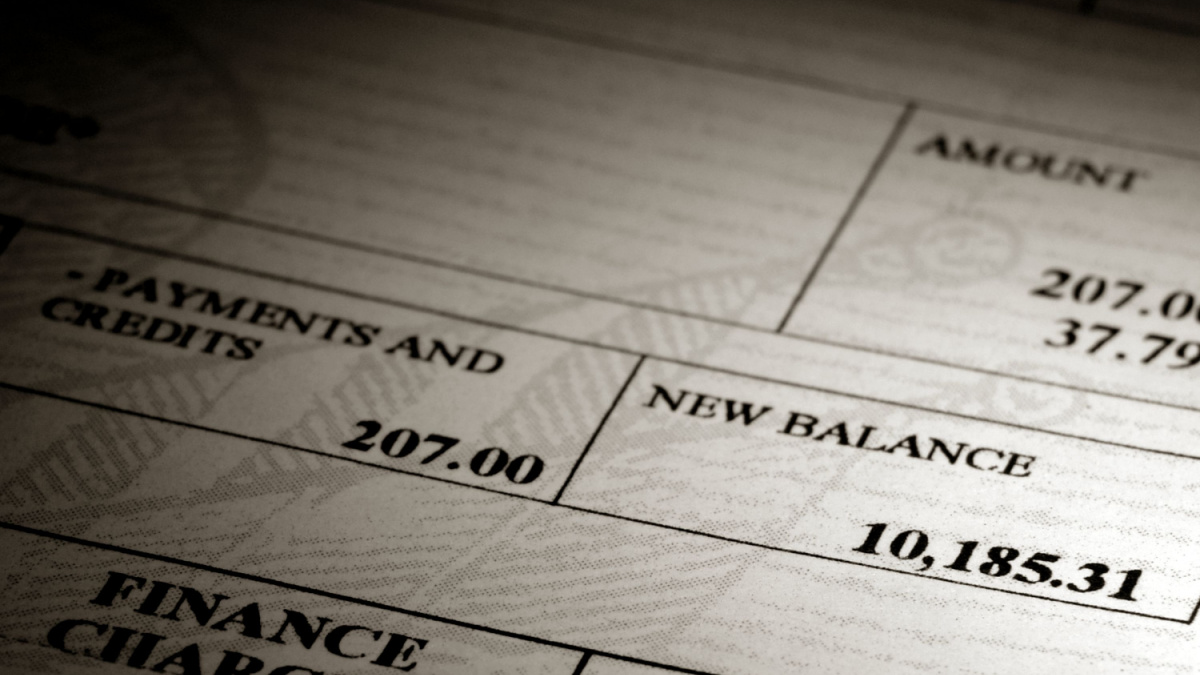

Paying the Minimum on Credit Cards

If you have a credit card to pay off and you are only paying the minimum monthly amount when you can be paying more, then you are making a huge mistake. The interest that builds up every month will cost you hundreds, and, if not thousands, so you’d be better off paying your credit card with as much money as possible each month.

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

I’m super frugal, and one of my passions is sharing my frugal living tips with everyone.

Here are some of my absolute favorite frugal tips to help you get started on your journey to frugal living.

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

Everything comes with a hefty price tag these days. From indulgences to essentials, the cost of living keeps rising. We used to consider certain items affordable options, but now they’ve become so expensive that they’re no longer worth it. Here are 15 things that have lost their affordability and make us wonder if they are worth it!

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

28 Practical Ways Frugal People Save Lots of Money

Saving money doesn’t have to mean saying goodbye to life’s little indulgences. With a few smart tweaks, you can stash away cash for that dream vacation, rainy day fund, or splurge-worthy purchase without feeling like you’re on a constant budget patrol.

Think of it as a side hustle that pays off without the extra hours. Whether you’re looking to conquer debt or simply boost your bank account, these tips are guaranteed to put more money in your pocket, painlessly.

28 Practical Ways Frugal People Save Lots of Money

20 Poor Hacks Frugal People Use on a Fairly Regular Basis

Even if you’re not poor, you sometimes feel that way, and you probably have some tricks and tips for coping with that. In this article, we’ve compiled several poor hacks that people utilize at least a few times a month or even a week. It’s always good to share these hacks; we hope some of them help!

20 Poor Hacks Frugal People Use on a Fairly Regular Basis

10 Hard Financial Truths About Aging You Can’t Afford to Ignore

Getting older is a difficult thing to face. Unfortunately, it also comes with certain financial considerations that will affect your retirement planning. Here are 10 hard financial truths about aging that you can’t afford to ignore.

10 Hard Financial Truths About Aging You Can’t Afford to Ignore