Looking to save more money each month without making huge sacrifices? Check out these 14 simple yet effective changes that can add up over time. They’re all about tweaking your daily habits and making smarter choices that can lead to more money in the bank.

1. Cutting Out Sale Alerts

Hitting that unsubscribe button on sale alerts can save you from those sneaky impulse buys. It’s like putting blinders on a horse; you only see what you need, helping you stick to your budget.

2. Bulk Buying

Shopping at bulk stores for your pantry and household items is a total win. You get more bang for your buck and fewer shopping trips, keeping both your wallet and pantry full.

3. Fun and Frugal Hobbies

Dive into hobbies that are not just fun but also save you money. Whether it’s baking, crocheting, or any other productive hobby, you end up with great results without spending a fortune.

4. Coupon Codes

Always take a minute to search for coupon codes before you check out online. It’s like a quick scavenger hunt that can lead to easy savings, like knocking a few bucks off your total.

5. Using Wishlists

Feel the urge to buy something online? Chuck it in your wishlist or cart and give it a day or two. This cooling-off period can curb the impulse to buy immediately and might even reward you with a discount.

6. Expense Tracking

Keeping a close eye on where your money goes with Excel can be eye-opening. Separate sheets for different expenses help you spot where you can cut back.

7. Credit Union Switch

Moving your money to a credit union can cut down on fees and minimum balance requirements. It’s a straightforward switch that keeps more money in your pocket.

8. Sneaky Savings

Automating a slice of your paycheck directly into savings is like saving without thinking. You stash away cash before you have the chance to spend it, building your savings effortlessly.

9. Roth IRA Route

Investing in a Roth IRA is playing the long game for a tax-free future. You contribute after-tax dollars, but when it’s time to retire, you withdraw the funds tax-free.

10. Generic Meds Go-to

Get to know the generic names for common meds and buy them instead of the brand names. It’s a smart move that keeps you healthy without the high costs.

11. No-Spend Challenge

Commit to not spending any money for a full day each week. It’s a simple strategy that reduces your weekly spending and teaches you to value what you already have.

12. Set Everything to Autopay

Automating your bill payments means you never miss a due date. It’s like having a personal assistant who makes sure everything is paid on time, which can save you from late fees and stress.

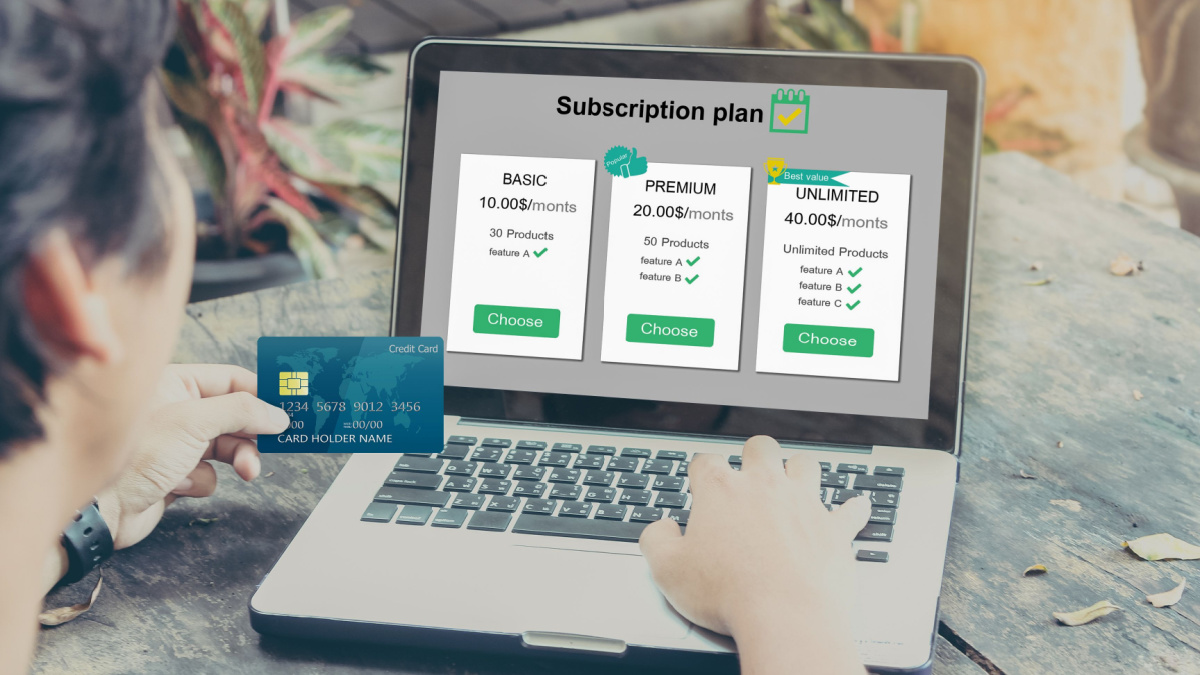

13. Limit Subscriptions

Take a hard look at all your monthly subscriptions and keep only the ones you use. You’ll be surprised how much you can save by cutting out unneeded subscriptions.

14. Open a Rewards Credit Card

If you’re responsible with credit, a rewards card can be like getting paid to shop. Just use it for your regular purchases, pay off the balance each month, and watch the rewards pile up, which you can use to save on travel, shopping, or even get cash back.

15 Items That Used to Be Cheap but That Are Now Shockingly Expensive

It’s no secret that the cost of living continues to rise. While some items have remained affordable, others have seen significant price hikes that might shock you.

From everyday essentials to guilty pleasures, here are 15 items that have become shockingly expensive.

15 Items That Used to Be Cheap but That Are Now Shockingly Expensive

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

I’m super frugal, and one of my passions is sharing my frugal living tips with everyone.

Here are some of my absolute favorite frugal tips to help you get started on your journey to frugal living.

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

Everything comes with a hefty price tag these days. From indulgences to essentials, the cost of living keeps rising. We used to consider certain items affordable options, but now they’ve become so expensive that they’re no longer worth it. Here are 15 things that have lost their affordability and make us wonder if they are worth it!

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

28 Practical Ways Frugal People Save Lots of Money

Saving money doesn’t have to mean saying goodbye to life’s little indulgences. With a few smart tweaks, you can stash away cash for that dream vacation, rainy day fund, or splurge-worthy purchase without feeling like you’re on a constant budget patrol.

Think of it as a side hustle that pays off without the extra hours. Whether you’re looking to conquer debt or simply boost your bank account, these tips are guaranteed to put more money in your pocket, painlessly.

28 Practical Ways Frugal People Save Lots of Money

14 Ridiculously Random Tips That Could Save You Lots Money

Want to save some money? There are so many ways to save money that are published in articles all day, every day.

It can be tiring to sort through them and find the ones that work for you, so we decided to scour the internet and find some of the best ones to share with you. But we couldn’t decide which ones to share with you, so we just decided to share the ones we liked, which means that these are pretty random!

14 Ridiculously Random Tips That Could Save You Lots Money