Scammers are becoming increasingly sophisticated, finding new and creative ways to defraud unsuspecting individuals of their hard-earned money. No aspect of daily life is free from potential fraud, from the digital to the tangible.

Here are 20 of the most prevalent scams and frauds that people fall for daily, arming you with the knowledge to stay one step ahead.

1. The Virus Call from “Microsoft”

A classic yet still effective scam, it involves individuals receiving a call from someone claiming to be from Microsoft or another tech giant, stating that their computer is infected with a virus. The scammer then requests remote access to fix the issue, aiming to steal personal information or install malware. It’s happening to individuals and large corporations alike.

2. Multi-Level Marketing Scams

These schemes promise wealth and success by selling products and recruiting others to do the same. However, the structure benefits those at the top, leaving most participants with unsold products and financial losses. You must get to the bottom of the fine print before signing up.

3. Phishing Scams

Phishing scams use fake emails or websites to mimic legitimate organizations, tricking individuals into providing sensitive information. These scams exploit trust and can lead to identity theft and financial loss.

4. Money-Making Courses from Influencers on Social Media

Influencers often promote courses promising secrets to wealth and success. However, these expensive courses rarely deliver on their promises, benefiting only the influencers who sell them. Those “free” ones are usually just held to sell their other services or products.

5. Reverse Mortgages

While appealing to seniors seeking extra income, reverse mortgages can have high fees and interest rates, potentially resulting in the loss of their home if they cannot comply with the loan terms. Not all companies are scammers, but it’s often found that they aren’t all that clear with the terms upfront.

6. Extended Warranties

Often pushed at the point of sale, extended warranties rarely provide the value they promise, covering less than expected and costing consumers more in the long run. Sometimes, they may be worth it, but it’s important to get all the details in writing.

7. Rent to Own Furniture

This scheme allows consumers to rent furniture with the option to buy, but exorbitant interest rates and fees can result in paying the item’s original value many times. At the same time, some people’s financial situation makes this their only choice. You can often find cheap pieces online and purchase one item at a time.

8. Payday Loans

Offering quick cash for those in need, these loans come with astronomical interest rates, trapping borrowers in a cycle of debt that is difficult to escape. It’s even worse when you’ve provided your car for collateral. When you cannot pay, you are in a deeper hole than before.

9. Social Security Calls Asking for Your SSN

Scammers posing as government officials claim there’s a problem with your Social Security number or account. They ask for your SSN to confirm your identity, aiming to steal your identity. So that you know, the Social Security Administration will never call and ask you for personal information by phone.

10. The “I’m Stuck in a Country and Need Money” Scam

A classic scam involving a supposedly stranded friend or relative asking for money to return home. Once the money is sent, it’s lost forever, and the stranded individual is revealed to be a scammer. Hang up and reach out to your friend or loved one. Chances are they are just fine!

11. “Hot Singles Want to Meet You” Emails

These phishing emails lead to sites that steal personal and financial information or infect your device with malware, preying on personal desires for connection. Make real connections on reputable sites.

12. Crypto Scams Promising Big Returns

With the rise of cryptocurrency, so too have scams promising guaranteed returns. These schemes often result in significant investment losses with no real way of getting them back. Learn all you can about crypto before getting involved, and don’t send people money online.

13. Going Out of Business Sales

Retailers announce going-out-of-business sales offering terrific deals but then open up in a new location shortly after. These sales often have inflated prices and strict no-return policies. It happens all over the country, with some customers none the wiser.

14. Catfish Scams

Scammers create fake online profiles to form relationships. Eventually, they convince their victims to send money for various fabricated reasons, exploiting emotional vulnerability. If they won’t video call with you, you’re probably not talking to who you think you are.

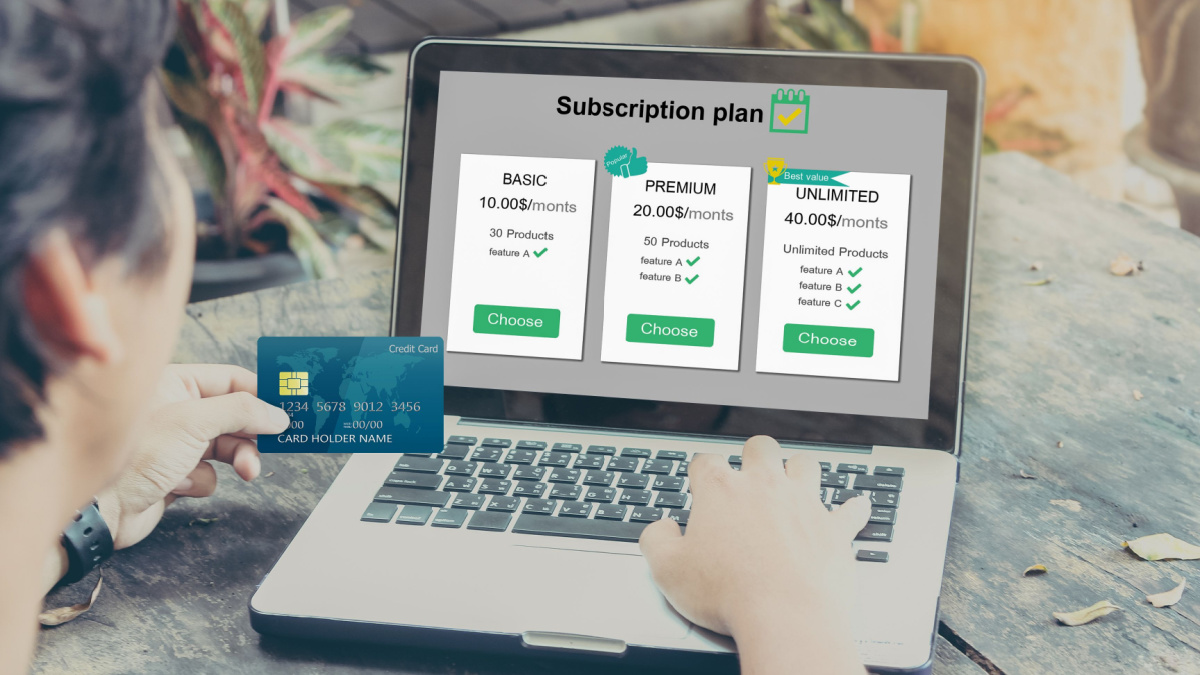

15. Auto Charge Subscription Services

Consumers sign up for a free trial or a service only to find it nearly impossible to cancel the auto-renewal, which results in recurring charges for unwanted services. It’s essential to get the details of how to cancel. If you can’t get help from the company, call your bank or credit card company.

16. Day Trading

Promoted as an easy way to make quick money, day trading involves significant risk. Many are lured by the potential for high returns but end up with substantial losses. Remember that if it sounds too good to be true, it probably is.

17. “Unauthorized Spending” Calls

Scammers pretending to be from your bank or credit card company claim to have detected unauthorized spending and ask for your account details to “secure” your account, only to use them for fraudulent purposes. Hang up and call your bank or credit card company yourself.

18. UPS and USPS Scam Emails About a Package

These emails claim there’s a problem with package delivery and ask you to click a link to resolve the issue, leading to phishing sites designed to steal personal information. Don’t click the link. Contact the shipping company directly.

19. Article Clickbait with Flashy Titles

Clickbait articles lure readers with sensational headlines but lead to websites that host malware or phishing scams, exploiting curiosity for malicious gain. These can waste our time and cost some people money. Stick to articles from reputable publications.

20. Fake Sweepstake Winner Emails

These emails congratulate you on winning a sweepstake you don’t recall entering and ask for personal information or a fee to “release” your prize, which never arrives. Ignore these and mark them as spam.

15 Behaviors That Are a Dead Giveaways Someone Grew up Poor

Many people who grew up poor don’t exactly want to display this information for the world to see. However, it can come out in a wide range of behaviors that make it obvious that the person grew up lower class or in poverty.

Many people have habits that they picked up during those years that they haven’t let go of yet.

15 Behaviors That Are a Dead Giveaways Someone Grew up Poor

15 of the the World’s Greatest Lies

There’s a lot of misinformation out there. Information is often wielded as a weapon and used against the public. Some lies are so colossal that they’re practically universal in our society.

15 of the World’s Greatest Lies

15 Things That Feel Illegal but Are Actually Perfectly Legal

Life is full of peculiar situations where our instincts often tell us that something just can’t be legal, yet the truth might surprise you. Here are 15 things that might feel illegal but are entirely within the bounds of the law.

15 Things That Feel Illegal but Are Actually Perfectly Legal

12 Things That Were Socially Acceptable 25 Years Ago, but Are Frowned Upon Today

Over the past 25 years, society has seen significant changes in what it considers acceptable behavior. What was once deemed perfectly fine in the past is now often met with disapproval. As cultural norms and values continue to evolve, it’s essential to reflect on these changes and how they shape our daily lives.

12 Things That Were Socially Acceptable 25 Years Ago, but Are Frowned Upon Today

12 Things You Really, Really Don’t Need In Your Home

One of the best ways to save money is to learn to live with less. If you live on less, then you need less and then you spend less. There are some stuff that you may have in your home that you don’t need.

There are several ways that you can adjust your lifestyle and learn to live with less. Here are some things you have in your home that you don’t need.

12 Things You Really, Really Don’t Need In Your Home