Life is a journey, not a destination. And so is budgeting! Here are fifteen money-related concepts to help keep your eyes on the prize: a healthy relationship with your finances!

Less Is More

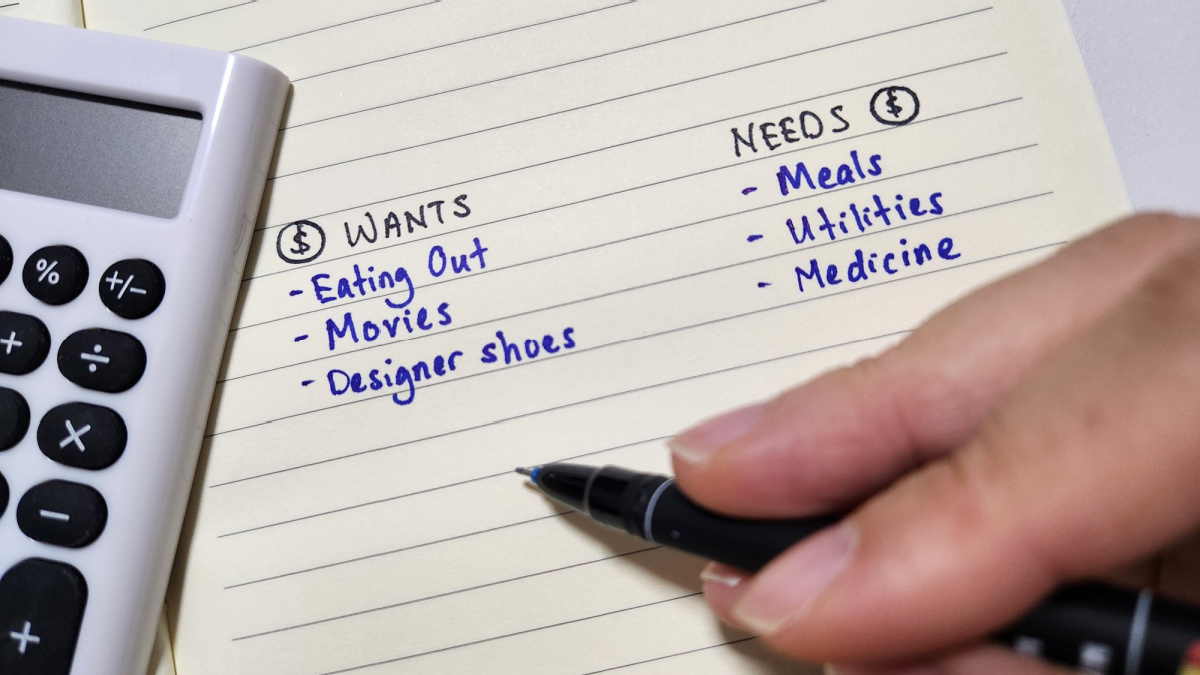

Philosophers and financial bigwigs agree: we often struggle with money because we struggle with wants versus needs. Living with less is often the key to a more fulfilled life and saves you money!

Comfort, Not Status

Approaching money from the angle of being more comfortable rather than something that gives you social status will help inform your budget in a much more realistic way.

Debt Is Debilitating

If there’s one thing threatening your good relationship with money, it’s debt. Do whatever you can to lower it every chance you get.

Lower Expenses First, Raise Income Later

Focusing on lowering your expenses shows a dedication toward a more frugal mindset.

Invest in Yourself

Your health takes priority. But not just for a better life but a more financially sound future! Healthcare is expensive, so take your physical and mental health seriously.

Heal Your Relationship With Money

Money is, understandably, a complicated concept for many. Before you can have a happy relationship with money, you have to manage any negative thoughts you might have lingering around it.

Stay Goal-Oriented

You’re the only one in charge of your life; remember how important your goals are to you and keep yourself on track, even when the going gets tough.

Real Estate Isn’t Always the “Best” Investment

Homeownership is undoubtedly a good investment, but is it always the best? It’s not for everyone, so don’t feel pressured if you feel like becoming a homeowner doesn’t align with your financial endgame.

Money Can Increase Comfort, but It Won’t Make You Happy

The adage “money can’t buy happiness” is mostly true. Still, people forget that it can facilitate more happiness by keeping your basic needs met. But it’s still important to remember that ultimately, happiness and unhappiness are something anyone can experience, regardless of their financial status.

Emphasize Value Over Price

People often confuse value with price; value focuses more on what things are worth than how much they cost. Everyone will have a different idea of what something is worth; know what you consider valuable and not hesitate to spend more on it for a better quality of life.

Wait It Out

If you’re making a large purchase, give it a second: there’s a good chance you either haven’t done your research to get the best price or don’t even need it in the first place.

Think Long-Term

Money issues often stem from being too short-sighted with your financial goals; think about what future you would want!

Be Patient

This tip is vital if you’re investing, but everyone should know that financial security doesn’t happen overnight.

Be Generous

This might seem like another strange tip, but if you’re serious about having a fulfilling life, trust us: donating money when you can is an excellent way to ensure one.

Prioritize Your Well-Being

Money truly isn’t everything; if you’re having a day where you’re struggling and need a beat, don’t hesitate to take some time off or spend more on self-care. You always come first because the happier you are, the easier it is to achieve your goals.

15 Items That Used to Be Cheap but That Are Now Shockingly Expensive

It’s no secret that the cost of living continues to rise. While some items have remained affordable, others have seen significant price hikes that might shock you.

From everyday essentials to guilty pleasures, here are 15 items that have become shockingly expensive.

15 Items That Used to Be Cheap but That Are Now Shockingly Expensive

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

I’m super frugal, and one of my passions is sharing my frugal living tips with everyone.

Here are some of my absolute favorite frugal tips to help you get started on your journey to frugal living.

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

Everything comes with a hefty price tag these days. From indulgences to essentials, the cost of living keeps rising. We used to consider certain items affordable options, but now they’ve become so expensive that they’re no longer worth it. Here are 15 things that have lost their affordability and make us wonder if they are worth it!

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

28 Practical Ways Frugal People Save Lots of Money

Saving money doesn’t have to mean saying goodbye to life’s little indulgences. With a few smart tweaks, you can stash away cash for that dream vacation, rainy day fund, or splurge-worthy purchase without feeling like you’re on a constant budget patrol.

Think of it as a side hustle that pays off without the extra hours. Whether you’re looking to conquer debt or simply boost your bank account, these tips are guaranteed to put more money in your pocket, painlessly.

28 Practical Ways Frugal People Save Lots of Money

14 Ridiculously Random Tips That Could Save You Lots Of Money

Want to save some money? There are so many ways to save money that are published in articles all day, every day.

It can be tiring to sort through them and find the ones that work for you, so we decided to scour the internet and find some of the best ones to share with you. But we couldn’t decide which ones to share with you, so we just decided to share the ones we liked, which means that these are pretty random!

14 Ridiculously Random Tips That Could Save You Lots Money