It’s time to put away the excuses and start making your goals happen! Here are fifteen ways anyone can start building up their savings on any budget.

1. Make a Grocery List

It sounds so simple, but if you don’t make grocery lists, then you have no clue how effective it is at saving you money. Sticking to the list will keep impulse purchases down, bringing your overall grocery expenses down every month.

2. Suggest Something Free

In a world where all your friends are trying to try the new wine bar or nab some concert tickets, there’s a lot of fun for you without spending a dime. It just takes a little bit of searching.

3. Use Your Creativity When Giving Gifts

A good gift doesn’t have to be expensive. Show someone you care by getting them something specific to them that money can’t buy, and keep some money for your savings account come the holidays or birthdays.

4. Swap Cell Phone Plans

If it’s been a while since you’ve shopped around for cell phone plans, you could be paying way too much for your service. See what else is out there and make the swap to save.

5. Find Free Stuff

There are websites entirely dedicated to swapping items or giving them away to whoever wants them. Before you shop for something new, check here first, and put the money you would have spent on it in your savings.

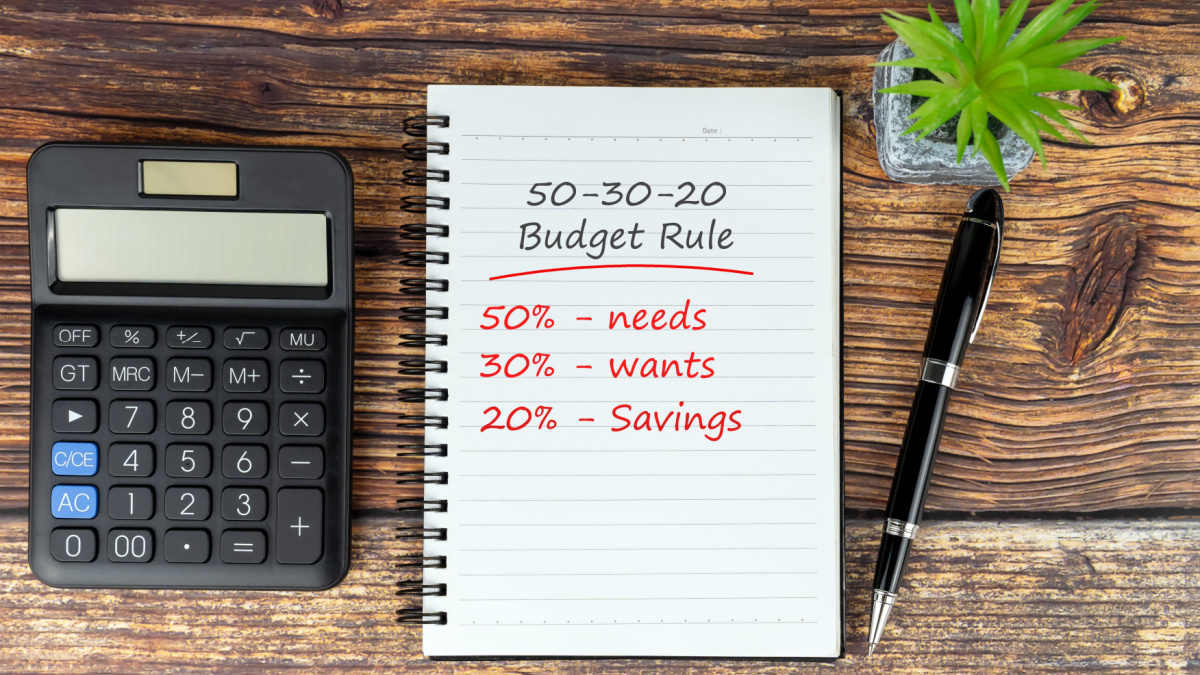

6. Budget Your Savings

Even those who have one won’t include their savings in their budgets. But if you do, you’ll have no choice but to put money away, even if it’s only a few bucks a week.

7. Monitor Potential Purchases

Prices for everything fluctuate: monitor the next thing you’re looking at buying and try to pick it up when it’s at its lowest. This works incredibly well for big-ticket items or flights.

8. Set up Automatic Transfers

What’s the best way to prevent yourself from spending your savings? Don’t give yourself the chance to spend it in the first place by automatically transferring a set amount to your savings account.

9. Audit Your Expenses

When did you last take a good, hard look at your budget? There are probably some spots where you could tighten up and put that money toward your savings.

10. Don’t Worry About the Amount

Many people don’t even bother saving money because they think a few dollars here and there doesn’t matter. But it all adds up, so don’t let the smaller deposits deter you from reaching your goals.

11. Think About the Future You

Before making money decisions, ask yourself if you would benefit more from putting this money away in a savings account rather than spending it.

12. Make Coffee at Home

Buying a coffee every morning is an insanely expensive luxury compared to making a pot at home. Even if you teach yourself to make the fancier beverages, you’ll still save a lot of money. (Don’t forget to treat yourself now and then still when you can!)

13. Know Your Pitfalls

Where do you struggle most with your finances? Be honest with yourself about where that is, and make a point to avoid them in the future. Reward yourself by putting whatever money you would have spent into your savings account.

14. Say No to Yourself

Knowing the difference between the money you need to spend and the money you want to spend is vital. Every budget should have space for enjoying life, but double-check before you immediately give in to that purchase you’re eyeing up.

15. Use Coupon and Cash Back App

Many apps are designed to help you save money on everyday purchases. Download them, take whatever money you save, and put it in a savings account.

7 Frugal Habits of Millionaires

Most people think millionaires aren’t all frugal, but did they ever stop to wonder how millionaires got so rich in the first place?

Maybe, just maybe, they started out with modest, frugal lifestyles to get to their millionaire status. Here are some ways in which millionaires lead their lives to live up to their millionaire rankings.

7 Frugal Habits of Millionaires

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

I’m super frugal, and one of my passions is sharing my frugal living tips with everyone.

Here are some of my absolute favorite frugal tips to help you get started on your journey to frugal living.

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

Everything comes with a hefty price tag these days. From indulgences to essentials, the cost of living keeps rising. We used to consider certain items affordable options, but now they’ve become so expensive that they’re no longer worth it. Here are 15 things that have lost their affordability and make us wonder if they are worth it!

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

28 Practical Ways Frugal People Save Lots of Money

Saving money doesn’t have to mean saying goodbye to life’s little indulgences. With a few smart tweaks, you can stash away cash for that dream vacation, rainy day fund, or splurge-worthy purchase without feeling like you’re on a constant budget patrol.

Think of it as a side hustle that pays off without the extra hours. Whether you’re looking to conquer debt or simply boost your bank account, these tips are guaranteed to put more money in your pocket, painlessly.

28 Practical Ways Frugal People Save Lots of Money

14 Ridiculously Random Tips That Could Save You Lots Money

Want to save some money? There are so many ways to save money that are published in articles all day, every day.

It can be tiring to sort through them and find the ones that work for you, so we decided to scour the internet and find some of the best ones to share with you. But we couldn’t decide which ones to share with you, so we just decided to share the ones we liked, which means that these are pretty random!

14 Ridiculously Random Tips That Could Save You Lots Money