Have you ever been told a story and it just keeps going? Even years later, you hear the same story over and over again. Professor Harold Pollack wrote what we would call today a viral financial 3×5 card. Professor Pollack stated in a video chat with personal finance writer Helaine Olen. He explained in the video that the best financial advice could fit on a 3×5 card. The question is what made this 3×5 card viral?

Does going viral mean that Professor Pollack had something really spectacular to say or was the video chat with personal finance writer Helaine Olen just really popular? There’s only one way to find out, so follow along with me and let’s take a look at the advice.

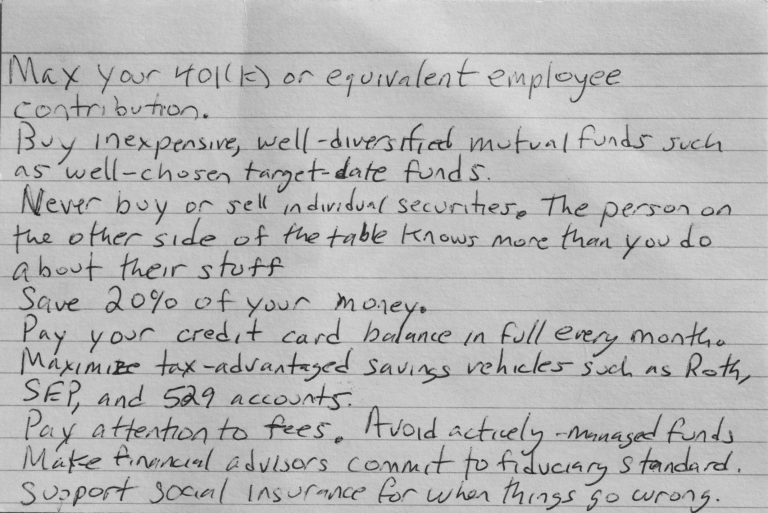

Financial Advice On a 3×5

- Max out your 401(k) or at least add enough to ensure you get the free money which is their contribution.

- Target Date Funds, Mutual Funds and other less expensive funds are your best bet. They are diversified and generally do well. Still all investments have risks.

- Never buy or sell individual stocks unless you know what you’re doing and have had enough experience to know you risk tolerance. The investors on the other side have better information.

- Save, save, save. If you can save 20% of your income and invest in cheaper funds, you’ll be set when you’re ready to retire.

- Pay your credit card in full each month. Never just pay the minimum or you’ll be a member for life.

- Tax advantaged savings vehicles should be maximized. Get a Roth IRA, SEP or 529 account to help your kids pay for college. All of these will help cut down on your tax bill depending on how much you make.

- Know the fees your fund managers are charging you. Too many fees equal very little profit for you.

- There is a standard that Financial Advisors are to adhere to, ensure that yours is looking out for your best interest, not their own.

- Support social insurance for when things go wrong. Bad things happen to good people all the time support government programs that can help you in your time of need.

All of these little nuggets of advice offer us the basic tools to be financially successful. This is what keeps this 3×5 card spreading.

Want To Read More About Finance?

- How to Retire Happy, Wild, and Free-If you want a book about the best ways to enjoy retirement and be prepared for it, then this book by Ernie Zelinski is a great read.

-

The Motley Fool You Have More Than You Think-David and Tom Gardner the Cofounders of The Motley Fool has been giving financial advice through their website for years, this book takes the best of their advice and puts it into one place to help you take control of your personal finances.

Tamila McDonald has worked as a Financial Advisor for the military for past 13 years. She has taught Personal Financial classes on every subject from credit, to life insurance, as well as all other aspects of financial management. Mrs. McDonald is an AFCPE Accredited Financial Counselor and has helped her clients to meet their short-term and long-term financial goals